Impact is what drives us. We associate with investors and businesses whose goals are synonymous with our vision to create meaningful impact based on three major focus areas –

1. Livelihood for Underserved Communities

We believe that fair economic development comprises economic inclusion. We are working toward building an inclusive economy by creating livelihood opportunities for underserved communities, enabling social upliftment and a life of dignity for them.

2. Climate Action

We are building a portfolio of businesses that are climate-positive. Our pipeline and portfolio are regularly assessed for ESG compliance through our C4D ESG Toolkit. We are now also working on our C4D Climate Toolkit.

3. Gender Equity

We operate through a gender lens strategy, which is embedded throughout our investment process. We commit at least 30% of each of our funds to women-owned/led businesses, and our carried interest is linked to this gender goal.We also guide our portfolio to adopt appropriate gender practices through our Gender Lens Toolkit.

We strive to strike a balance between impact and financial returns.

Through our experience in the impact investment sector, we have learned that unlike traditional PE or VC funds that operate along the two dimensions of “risk” and “returns”, Impact Funds have a third dimension of “impact”. Along with financial returns, impact investments are expected to generate positive social or environmental outcomes.

Our belief is that growing businesses, particularly SMEs, hold the potential to transform economies and create sustainable social impact. Therefore, our impact investments are directed toward enterprises that have –

▸A business model that is woven around impact

Impact should be the core of the business. There must be intent to create positive social or environmental outcomes .

▸A business model that solves market inefficiencies

Competition is tough, and business models can be replicated. But if a business is solving a market problem, it strengthens its position in the market, creating a strong moat for itself.

▸Jobs that improve livelihood for underserved communities

The business must create livelihood impact for underserved communities by generating direct or indirect job opportunities for them. Thereby uplifting the people and creating an inclusive economy.

▸Conscious practices that promote climate action

Even if not proactively creating a positive impact for the environment, the company must be climate-positive or at least climate-neutral so as to not cause any irreversible damage to the environment through its practices.

▸Gender lens employed throughout business processes

The company should be aware and open to adopting business practices that promote gender equity at the workplace and across the supply chain.

In order to ensure compliance, we monitor and assess the business outcomes of our portfolio on a regular basis. Our investment team employs our in-house ESG and Gender Lens Toolkits to collect financial and impact data quarterly, generate quarterly and annual reports to analyze results and offer relevant and actionable feedback.

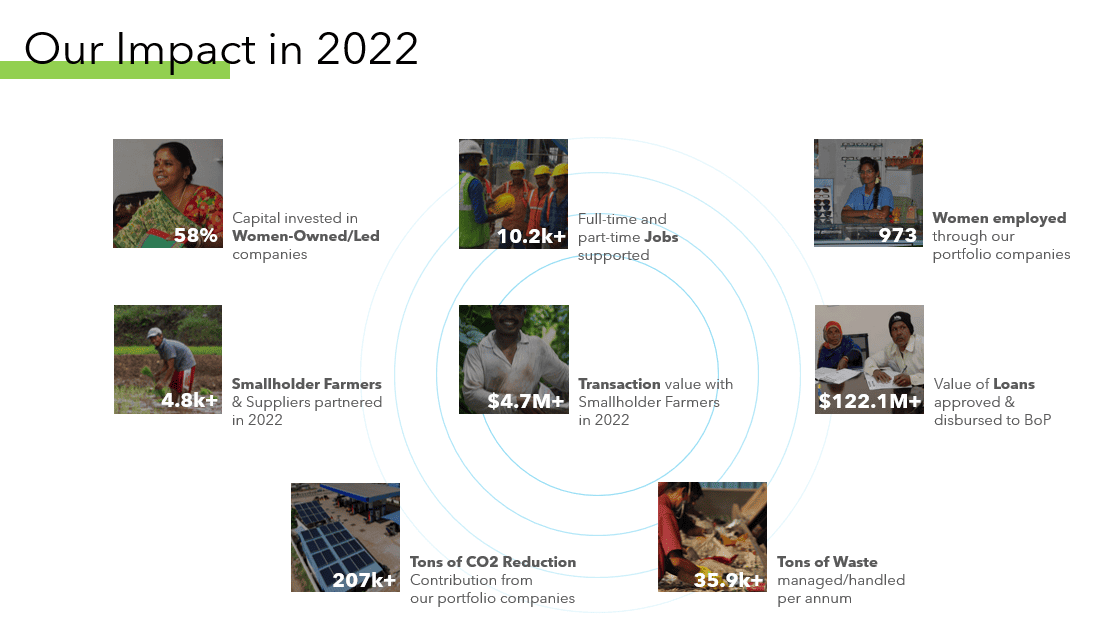

C4D Partners invests in purpose-driven entrepreneurs propelling meaningful impact for underserved communities in emerging markets. We work closely with our portfolio to help them optimize their targeted impact and balance it with committed financial returns. Highlights of our impact are showcased here.

We continually track, measure and record the total impact created on a quarterly basis. At the end of each year, we weave together all the numbers and experiences to develop a consolidated report, which is presented as our Annual Impact Report. You can read our stories of impact in our reports.

C4D Partners recognizes gender as a significant factor in its investment practice. We trust that participation of women in economic activities, as entrepreneurs, employees, or consumers, results in positive economic development that fosters social benefits for not only women, but also their families and the community.

At C4D Partners, we approach impact through gender-lens investing by focusing on businesses that are:

▸ Owned or led by women

▸ Encouraging workplace gender-equality

▸ Improving lives and economic prospects of women

We are hands-on investment professionals.

We believe in working closely with our portfolio and supporting our businesses to strike a balance between impact and growth. Over the years, we have built trustworthy relationships with our entrepreneurs and their teams, ensuring a cooperative partnership through challenging times as well.

This has helped us understand our entrepreneurs, businesses, and their challenges better. Having such comprehension strengthens our intent and ability to support our investee companies, and we achieve it through the C4D Portfolio Support Program (PSP).

The C4D PSP is a business development support and technical assistance services platform, designed meticulously to support the growth of the fund’s pipeline and portfolio companies and achieve strategic objectives. The purpose of the PSP is to improve the financial sustainability and organizational resilience of investee companies, by enabling the improvement of the company’s performance and potentially reducing the risks.